|

Getting your Trinity Audio player ready...

|

Financial institutions are at the forefront of technology innovation, delivering secure digital services and establishing trust with customers, stakeholders, and business partners. This need to maintain high standards of service, business continuity, and operational resilience is paramount to safeguarding customer data and financial records.

But as we have seen all too many times, these institutions face persistent cyber threats that target their digital attack surfaces, emphasizing the urgency of integrating robust security processes into their operations.

The ever-evolving threat landscape underscores the importance of adapting security posture, refining operational cadence, and fortifying cybersecurity defenses. To effectively address these challenges, a harmonious synergy between people, processes, and technology is crucial. The Digital Operational Resilience Act (DORA) has emerged as a critical regulatory initiative designed to support financial institutions in enhancing their operational resilience and cybersecurity stance.

Understanding DORA

The Digital Operational Resilience Act (Regulation (EU) 2022/2554) focuses on digital operational resilience within financial services, making it the EU’s primary regulatory initiative on operational resilience and cybersecurity. DORA aims to empower financial institutions to maintain control over ICT risk, establish comprehensive capabilities for effective ICT risk management, and implement protocols for handling ICT-related incidents and reporting major ICT-related events.

The Act also emphasizes the importance of testing ICT systems, controls, and processes, as well as managing ICT third-party risks. By creating a continuous cybersecurity lifecycle, DORA aims to optimize IT security and enhance digital operational resilience, enabling the financial sector to withstand and recover from various ICT-related disruptions and cyber threats.

Why DORA Is Essential

DORA serves as a universal framework for managing and mitigating ICT risk in the financial sector across the EU. By risk management regulations, DORA eliminates potential gaps, overlaps, or conflicts that may arise due to varying regulations among EU states. The Act requires firms to adopt a broader view of resilience with accountability at the senior management level, fostering a proactive approach to operational resilience. With enforcement set to commence in 2025, companies are encouraged to proactively prepare by performing gap analyses to assess governance, risk management, and compliance with existing guidelines. Non-compliance may result in financial penalties, demonstrating the importance of adhering to DORA’s guidelines.

Key Pillars of DORA

DORA outlines five essential areas that financial institutions must address to comply with the regulation:

- ICT Risk Management

- ICT-related Incident Management, Classification, and Reporting

- Digital Operational Resilience Testing

- Managing ICT Third-party Risk

- Information Sharing Arrangements

- Navigating ICT Risk Management

Establishing an ICT Risk Management Framework with XM Cyber

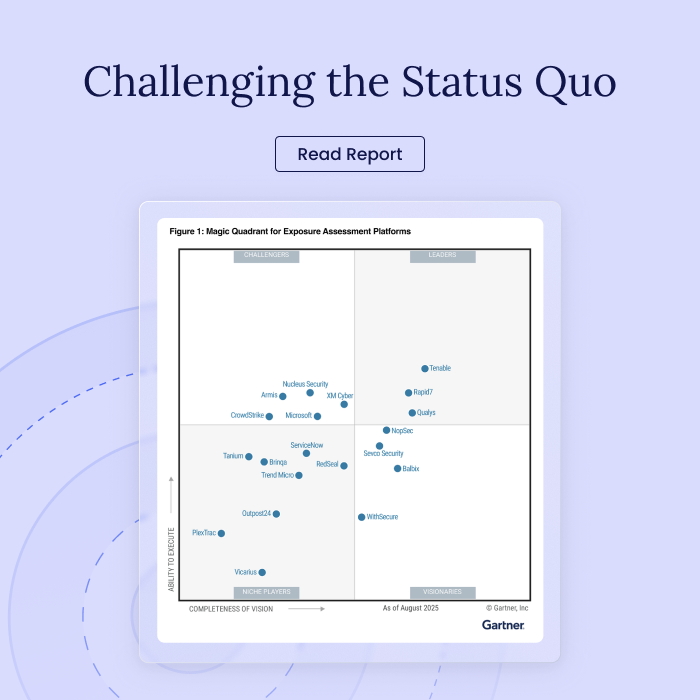

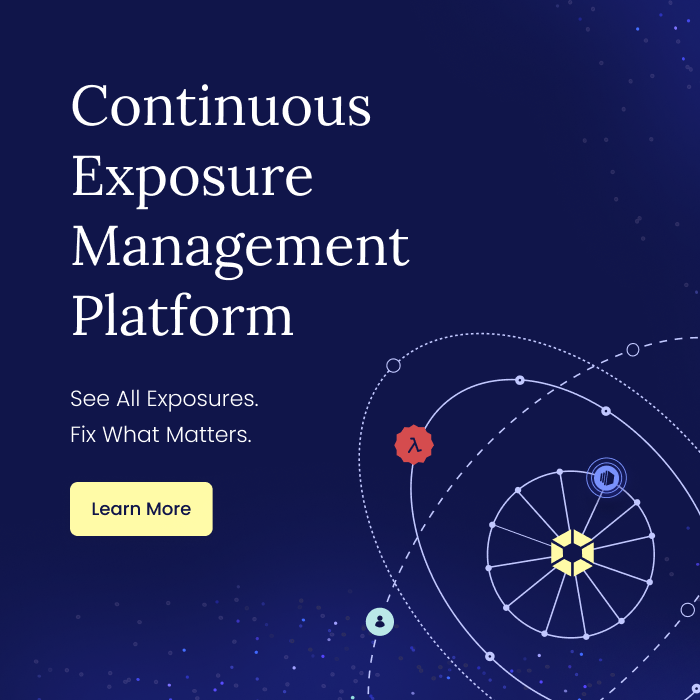

The goal of the ICT risk framework is to minimize the impact of ICT risk through the deployment of appropriate tools and strategies. XM Cyber’s Continuous Exposure Management Platform serves as a foundational component in delivering an ICT Risk Management Framework by identifying security exposures, validating exploitability, and prioritizing remediation efforts for business-critical ICT assets.

The platform quantifies exposure risks from vulnerabilities, misconfigurations, weak security postures, and other issues to establish a security posture baseline and enable proactive defense strategies. Key use cases for ICT Risk Management with XM Cyber include asset identification, risk quantification through Attack Graph Analysis™, remediation guidance, continuous testing, weakness detection in the attack surface, and contextual insights for post-incident analysis and risk management enhancement.

Enriching ICT-related Incident Management, Classification and Reporting

Financial entities need to have a deep understanding of the root causes of major ICT-related incidents and the cyber threats affecting their business operations and sensitive data. XM Cyber’s platform offers rich contextual information for post-incident investigation and root cause analysis. The platform provides valuable insights such as attack path visibility for advanced threat hunting, validated exposure exploitability findings to accelerate learning, and targeted remediation to minimize threat recurrence.

By leveraging these insights, financial entities can identify breach points, analyze attack techniques, and create new attack scenarios to assess the likelihood of similar incidents occurring in the future. The platform’s exposure risk awareness, facilitated by XM Attack Graph Analysis™, aids in correlating cyber threat likelihood with impact risk, enabling organizations to quantify the potential effects of cyber threats, including their geographical spread and impact on critical systems housing sensitive customer data.

Optimizing Digital Operational Resilience Testing

Continuous security testing is a core element of the XM Cyber Continuous Exposure Management platform, providing a comprehensive and automated approach to identifying high-impact risks to critical ICT assets. XM Cyber supports digital operational resilience testing through proactive exposure risk analysis, continuous threat-led penetration testing, and critical security control monitoring. The platform’s testing capabilities include vulnerability assessments, end-to-end testing, external exposure gap analysis, cloud security posture testing, and threat-led penetration testing.

For Threat-Led Penetration Testing, financial entities must conduct an extensive “Red team” exercise simulating real cyber attacks across digital, physical, and human attack surfaces. XM Cyber serves as a foundational tool for testing the digital attack surface and monitoring critical security controls to enhance infrastructure hardening and network security.

Risk Assessments for existing and future Third-party Service Providers

Financial entities must conduct thorough risk assessments of third-party ICT service providers to ensure alignment with regulatory requirements. XM Cyber’s platform offers two key benefits for managing ICT third-party risk: simplifying risk analysis through external exposure intelligence and providing continuous threat modeling for risks to business-critical assets from third parties and the supply chain.

This helps extend the ICT Risk Management Framework and Digital Operational Resilience Testing requirements to include third-party service providers. External Exposure Intelligence of Potential Third-party ICT Service Providers involves utilizing modules such as XM Attack Surface Management and XM Exposed Credentials for threat intelligence on service providers’ external attack surfaces. Continuous Threat Modeling assesses risks to critical assets from third-party systems through attack scenario creation. The platform’s contextual information can be integrated into incident management, cyber threat investigations, and information-sharing arrangements as outlined in Chapter IV.

Contextual Insights to Help Fostering Collaboration and Information Sharing

Threat actors leverage information sharing to enhance their cyber attacks, posing challenges for cybersecurity defenders and organizations. DORA aims to promote collaboration within the financial sector to address this issue. While this chapter focuses on the human and process aspects of cybersecurity, technology plays a crucial role. SaaS-based security solutions, like XM Cyber, offer a Collective Defense approach where data from individual tenants is analyzed collectively, enabling the tracking of anomalies and attack patterns. Leveraging security research specialists and MSSPs can further enhance this strategy.

Selecting security tools that provide rich contextual information on ICT risk and incidents is crucial for effective collaboration and information sharing. Establishing a GRC project team, fostering intelligence sharing, selecting qualified partners for support, and staying informed are key recommendations for effective information-sharing arrangements within DORA.

How XM Cyber accelerates DORA adoption

Quantification of risk using XM Attack Graph Analysis™

The risk intelligence and exposure insights to identify, prioritize and validate the exploitability of exposure across the digital attack surface. To help organizations define and optimize ICT Risk Management framework.

Enrich incident investigation to aid recovery and prevent future breaches

Holistic exposure intelligence and attack path insights to enrich advanced Threat Hunting and accelerate post-incident investigation. Tailor threat scenarios to focus on the exposure profiles of compromised assets to predict and prevent future breaches.

Prepare and simplify Digital Operational Resilience Testing

The XM Cyber platform delivers a comprehensive, continuous, and automated approach to support digital operational resilience testing. Covering a broad scope of testing requirements and accelerates readiness for Threat-Led Penetration Testing.

Conclusion

In conclusion, the Digital Operational Resilience Act (DORA) serves as a foundational methodology driving the innovation of digital financial services. Operational resilience and cybersecurity are essential for financial institutions operating in a dynamic threat landscape. DORA provides a structured approach to strengthen these defenses, requiring alignment of technology, people, and processes. It goes beyond a regulatory framework to shape the future of operational resilience in the financial industry, addressing challenges posed by persistent threats and competition.

While adopting DORA demands a comprehensive set of tools and capabilities, leveraging the XM Cyber Continuous Exposure Management Platform can help optimize ICT systems, mitigate risks, and enhance operational resilience. Partnering with XM Cyber enables financial entities to gain risk intelligence insights, expedite incident investigations, and streamline DORA compliance efforts. Embracing DORA and fortifying operational resilience will empower financial institutions to navigate digital complexities and protect their assets effectively.

To help set you off in the right direction, feel free to download our new Adopting DORA Security Checklist here: https://xmcyber.com/dora-checklist/

To learn more about DORA, check out our webinar, Demystifying DORA with XM Cyber, featuring Patrick Frech from KPMG: https://info.xmcyber.com/demystifying-dora-with-xm-cyber