|

Getting your Trinity Audio player ready...

|

Cybersecurity for High Value Assets

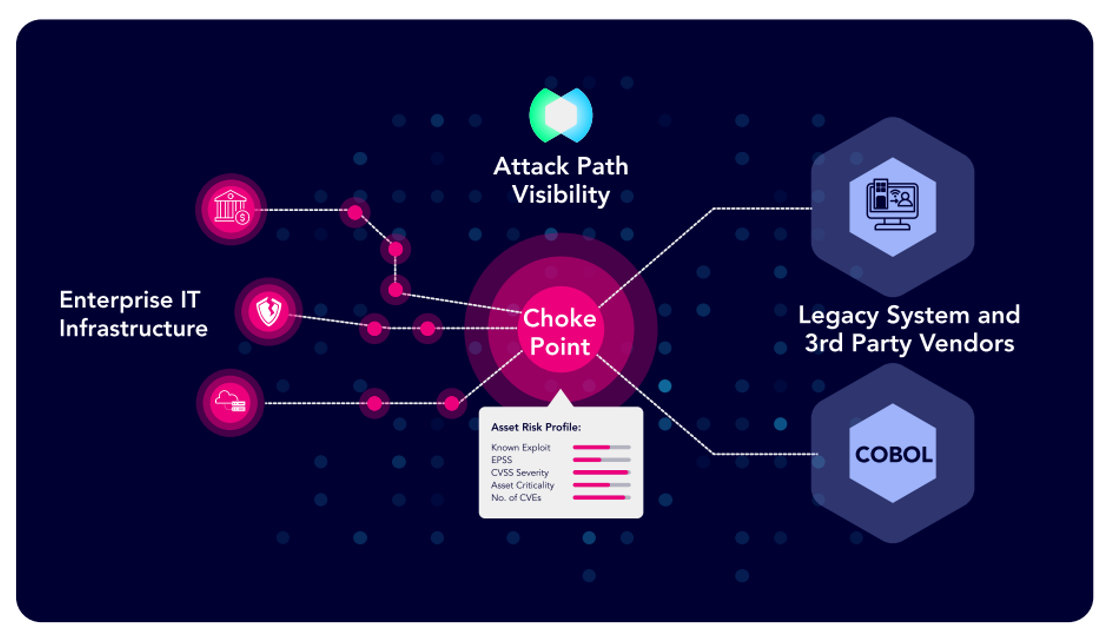

Financial services firms face cyber threats targeting the transaction systems, databases, and apps that house high-value assets and sensitive customer data. Attackers chain together exposures into an attack path to move laterally towards the business-critical assets housing this valuable data. Their dependance on legacy systems combined with regulatory compliance adds another layer of pressure, demanding continuous risk assessment and remediation.

Traditional approaches fail to provide the necessary visibility and prioritized guidance into the most impactful exposures. Security teams need more than just CVSS data, they need insights into fixing the riskiest exploitable exposures across hybrid environments, including legacy platforms.

Challenges for Financial Services

- Regulations (DORA GLBA,GDPR, PCI DSS)

- Digital Transformation

- Legacy Systems

- Cloud Migration

- Third Party Vendors

- Secure Mergers and Acquisitions (M&A)

How XM Cyber Helps Manage Risk in Financial Services Firms

Regulations:

Stringent regulations govern the financial sector and teams need reporting and analytics to maintain compliance with standards such as DORA, GDPR, GLBA, and PCI DSS.

Benefits: XM Cyber accelerates adherence to regulations, simplifies audit processes, and reduces compliance costs.

Digital Transformation:

The urgency to deploy innovative technologies, with a frictionless but secure user experience introduces the potential for additional exposures.

Benefits: With XM Cyber you can proactively and continuously assess how new services put the enterprise at risk, then mitigate these exposures before an incident.

Legacy Systems:

Financial services firms still rely on legacy platforms like COBOL or AIX to deliver critical services despite lack of built-in security and outdated architectures.

Benefits: XM Cyber extends the Attack Graph Analysis to these high risk assets. You can break the path to these assets and the business services that rely on them.

Cloud Migration:

The expanded attack surface and reliance on third-party security measures necessitate oversight and risk mitigation strategies.

Benefits: XM Cyber gives you visibility into your entire attack surface and lets you model how cloud services risks could lead to business-critical asset compromise.

Third-Party Vendors:

Strong due diligence practices and continuous monitoring of third-party security is critical to manage external risks.

Benefits: With XM Cyber move beyond compliance and ad-hoc penetration testing to have a continuous view of risk in the event that a connected third-party you use is compromised.

Secure M&A:

Consolidation and growth requires firms to perform frequent M&A. Despite research, each new acquisition represents complexity and risk.

Benefits: With XM Cyber teams can assess and model risk of the newly acquired firm. By assessing chokepoints and top attacks, security fixes what matters most.

Get a unified view of exposures throughout your extended attack surface and how they interconnect into attack paths towards the critical assets that drive your financial services firm. With XM Cyber you get the context to prioritize and fix the exposures with the highest remediation ROI to optimize resource efficiency.