|

Getting your Trinity Audio player ready...

|

Integrating exposure management into cyber insurance policies can dramatically reduce risks for insurers and slash premiums for businesses – a true win-win

Cyber insurance has shifted from “nice to have” to a precondition of doing business. From product sales to forging partnerships and raising capital – without cyber insurance, many organizations simply will not (or cannot) do business with you.

This has made cyber insurance a crucial component of cybersecurity strategy. In this post, we’ll take a deep dive into the connection between exposure management, underwriting and cyber insurance premiums.

Cyber Insurance – What and Why?

Like life insurance, car insurance and home insurance, cyber insurance is a risk management tool that provides financial protection against the impact of threats and incidents – in this case cyber threats and incidents. Cyber insurance is designed to help organizations mitigate the potentially devastating costs of data breaches, cyberattacks, and other digital risks.

Like with homeowner policies, cyber insurers commit to paying your organization in the event of an insurance incident. These payouts could cover legal fees, notification costs, public relations efforts, and direct financial losses that are incurred due to data destruction, hacking, data extortion, and the theft or misuse of sensitive information.

Also similar to homeowner policies, cyber insurance is underwritten according to whether or not an organization meets certain preconditions. Just like home fire insurance would not be underwritten for a house without smoke detectors, cyber insurance will not be approved unless an organization has certain cyber protections in place. The extent and types of protections required vary from insurer to insurer, as do the influence of these protections on the insurance premium.

Worthwhile? Cost of Cyberattack Vs Cost of Cyber Insurance

To make smart decisions about cyber insurance, it’s important to think about how much a cyberattack could cost compared to the price of a cyber insurance policy. When a cyberattack happens, it can lead to both direct and indirect expenses:

- Direct financial losses – Money spent on fixing systems, restoring data, and possibly paying ransom. It also includes losses from disruptions to business, like losing money or customers.

- Legal and regulatory issues – This involves dealing with legal problems, fines, penalties, and maybe even getting sued because of the cyberattack.

- Harm to reputation – A cyberattack can harm how people perceive a company, leading to a loss of trust. Fixing this involves spending money on things like public relations campaigns.

- Responding to the attack – Investing in figuring out how the attack happened, fixing the damage, and making security better for the future.

The cost of a cyber insurance policy and how much coverage is offered depends on a number of firmographic attributes like geography, industry, and company size, as well the organization’s current security stance. Insurance costs also consider factors like the risk of cyberattacks and the company’s past history with cyber incidents.

Cyber Insurance Drives Cyber Spending

Cyber insurance has become a pivotal driver that shapes cyber spending. Far from just a financial safety net, cyber insurance influences the way companies invest in cyber defenses. Why?

- Cyber insurance fosters risk awareness. Insurers often conduct thorough assessments of an organization’s cybersecurity posture, to identify vulnerabilities and suggest improvements. This risk evaluation prompts businesses to allocate resources that enhance their security, leading to increased cyber spending.

- Cyber insurance encourages continuous improvement. Insurers often offer discounts or reduced premiums for organizations that implement effective risk management practices. This incentive-driven approach motivates businesses to invest in advanced security technologies, employee training, and incident response.

- Cyber insurance influences strategic budgeting. Knowing that insurance coverage can mitigate the financial fallout of a cyber incident, organizations are more likely to allocate sufficient funds to cybersecurity initiatives, including regular system updates, threat detection tools, and employee awareness programs.

Cyber insurance acts as a catalyst for cybersecurity investment by creating a symbiotic relationship between financial protection and proactive risk management. As businesses recognize the interconnectedness of robust cybersecurity measures and insurance coverage, they are increasingly making strategic and sustained investments to safeguard digital assets and mitigate the impact of cyber threats.

Exposure Management and Cyber Insurance

Cyber insurers today are increasingly demanding validation of sufficient cybersecurity precautions as part of the underwriting process. Cyber insurers recognize that traditional insurance approaches, relying on one-time vulnerability scans and limitations to manage catastrophic cyber risks, are no longer sufficient. They’re requiring a more in depth pre audit evaluation, as well as a stronger security posture and an incident response plan. Policy holders are required to comply with these changes or face high increases in premiums. Basically, today’s cyber insurers adhere to the age-old Russian proverb: trust but verify.

Exposure management empowers organizations to identify, evaluate and mitigate risks that impact operational resilience, financial stability and even business continuity. Cyber insurance shares a vested interest in all these parameters. And that’s why we’re starting to see exposure management programs being mandated or at least incentivized in cyber insurance policies.

Exposure management baked into cyber insurance policies just makes sense, as it’s been proven to lower cyber risk and reduce loss. So, by incorporating exposure management into policies, cyber insurers reduce risk for themselves and for the businesses they insure, by helping those businesses improve their own security. It’s a win-win.

Cyber Insurance, Smarter

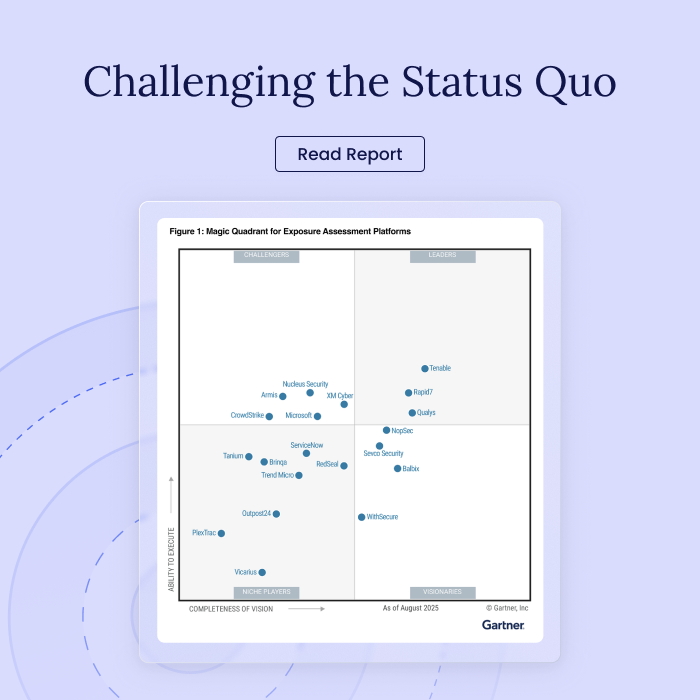

According to recent regulatory and insurer data, leveraging protective cybersecurity software and having a track record of reduced attacks has been shown to potentially dramatically reduce annual premiums. Exposure Management platforms that are recognized by insurers as offensive threat reduction tools and can document a history of lower attack breaches, reduce the premiums charged by cyber security insurance vendors. It’s that simple.

In fact, XM Cyber’s field staff have found that many customers are paying steep premiums for over insurance – sometimes 2-3 times their current calculated coverage amounts – even though there is a less than 50% probability of any insurance money ever being paid out. In these cases, these organizations achieve better ROI by lowering their coverage (and their premiums). That way, they can allocate those same budget dollars for solutions that reduce the offensive threat and likelihood of a breach to begin with.

Cyber insurance has transformed from nice-to-have to a business essential, and majorly influences cybersecurity strategies and budget allocations. The integration of exposure management into policies creates a symbiotic relationship that reduces risks for both insurers and businesses while driving smarter investments in cybersecurity.