Why Adopting DORA is Essential to Success

Financial institutions must uphold high standards of service, continuity, and resilience to protect data and combat cyber threats, while at the same time delivering innovation in secure digital services to drive growth, achieve differentiation, and build trust with both their customers and partners.

The evolving threat landscape demands constant adaptation of cyber defenses and the implementation of robust security processes.

The Digital Operational Resilience Act (DORA) is designed to help financial institutions address these growing challenges.

What is DORA? And Who Does it Benefit?

The Digital Operational Resilience Act (Regulation (EU) 2022/2554) addresses the topic of digital operational resilience for financial services. The DORA represents the EU’s most important regulatory initiative on operational resilience and cybersecurity.

DORA has been designed to help financial institutions maintain full control over Information and Communication Technology (ICT) risk, to establish comprehensive capabilities that have a positive effective ICT risk management. It also addresses specific mechanisms and policies for handling all ICT-related incidents and for reporting major ICT-related incidents. Likewise, financial institutes should have policies in place for the testing of ICT systems, controls, and processes, as well as for managing ICT third-party risk.

Steps to Success in Adopting DORA Check List

The steps outlined in the section are a summary of the key steps to success as they align to the 5 key pillars of the DORA regulation.

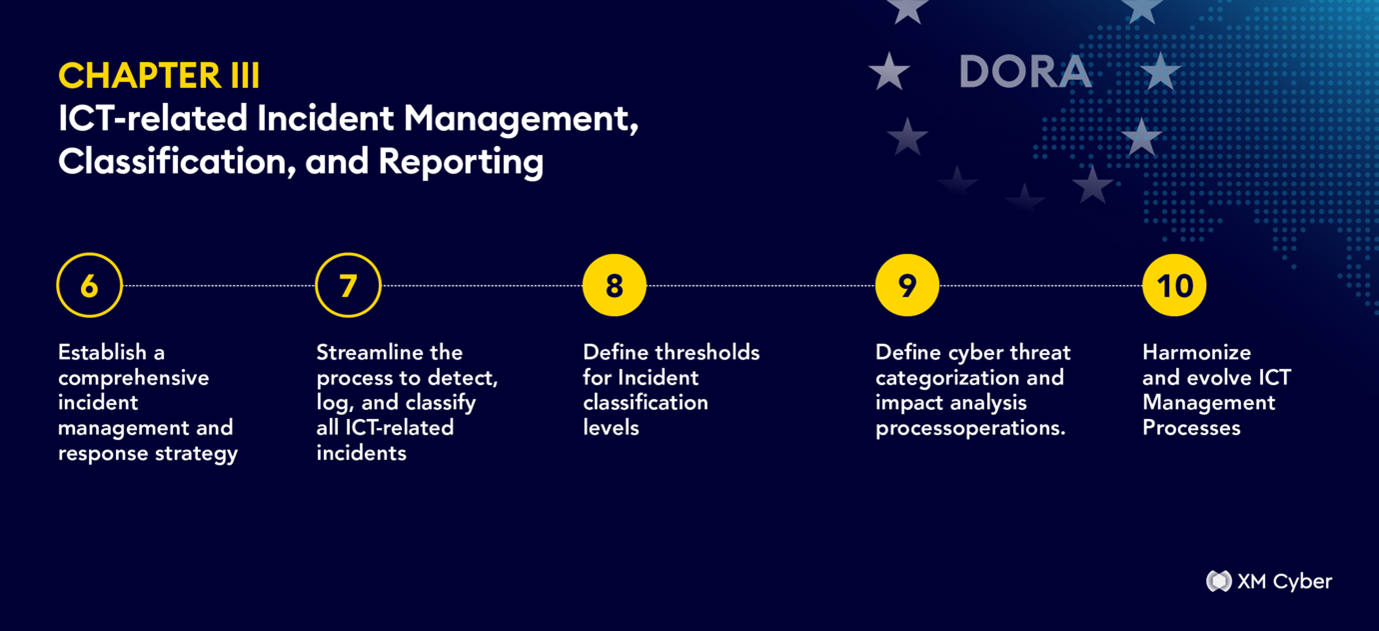

Chapter II- ICT Risk Management

☐ Document critical ICT Assets and Business functions:

Identify Critical Assets and align them to classification groups based on criticality levels.

☐ Initiate a Gap Analysis and document findings:

Discover exposure risks and weaknesses in security defense that could impact the integrity and availability of ICT systems and services.

☐ Define risk appetite and tolerance levels:

Monitor detection thresholds and related processes to ensure they remain in line with desired tolerance.

☐ Implement resilience of business-critical systems:

Ensure the safety, security, availability, integrity, backup, and recovery of ICT systems and Data.

☐ Establish a continuous learning and evolution cadence:

Regularly review and optimize your ICT Risk Management Framework.

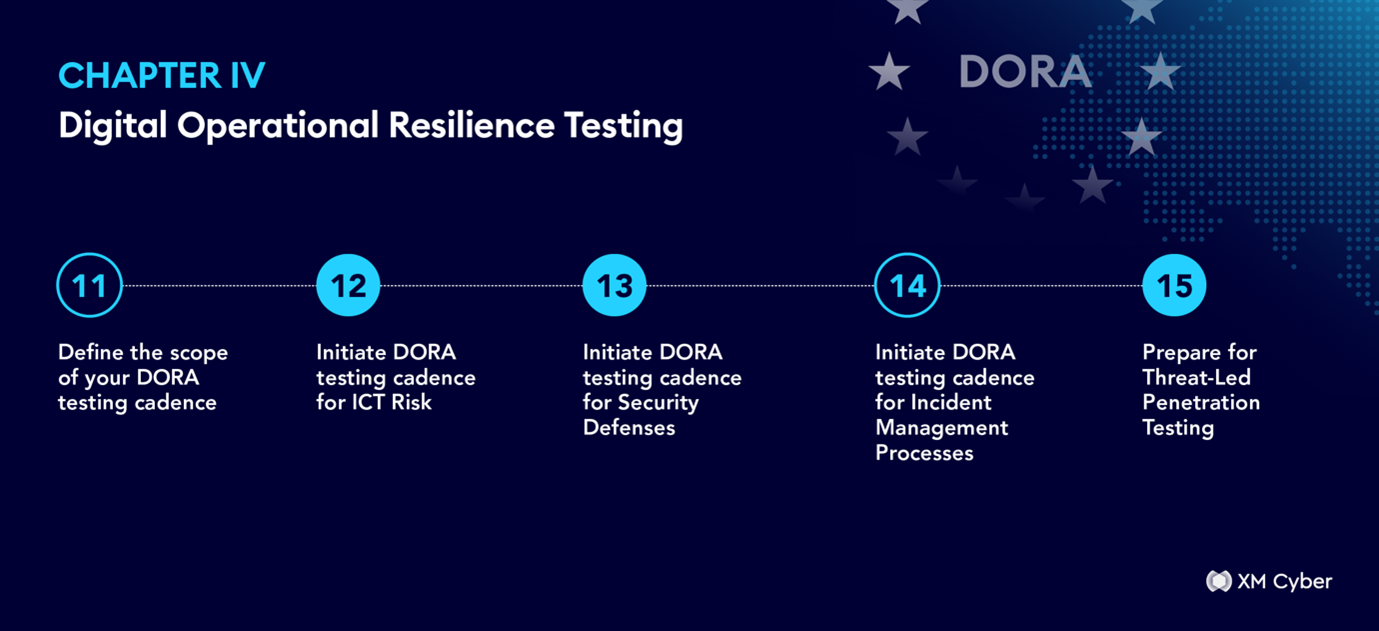

Chapter IV- Digital Operational Resilience Testing

☐ Define the scope of your DORA testing cadence:

That includes systems, tools, protocols, processes, and attack surfaces. Incorporate a preparedness analysis.

☐ Initiate DORA testing cadence for ICT Risk:

Conduct regular and comprehensive testing for all ICT exposure risks, across all attack surfaces.

☐ Initiate DORA testing cadence for Security Defenses:

Conduct regular and comprehensive testing for all security defenses, and threat detection solutions.

☐ Initiate DORA testing cadence for Incident Management Processes:

Conduct regular testing of ICT-related Incident Management Processes and systems and response measures.

☐ Prepare for Threat-Led Penetration Testing:

Select suitable partners and tools in order to implement a Threat-Led Penetration Testing (TLPT) cadence. Incorporate a preparedness analysis, of all attack surfaces.

Chapter V- ICT Third-Party Risk Management

☐ Create a register of third-party ICT-related service providers:

Document and report a complete register of third-parties including outsourced activities and the risk they may pose to digital services and resilience.

☐ Declare which of the above provides Critical ICT services:

Specify which third-parties deliver services deemed critical to the operation of the business.

☐ Define Oversight committee, with roles and responsibilities:

Review the requirements of the Lead Overseer for each ICT-related service provider.

☐ Initiate DORA testing cadence for ICT-related third-party risk:

Conduct regular testing of ICT-related service providers, in line with your ICT risk management framework.

☐ Harmonize processes and communication with partners:

Work with ICT-related service providers to continually learn and evolve risk analysis, testing, and communication processes.

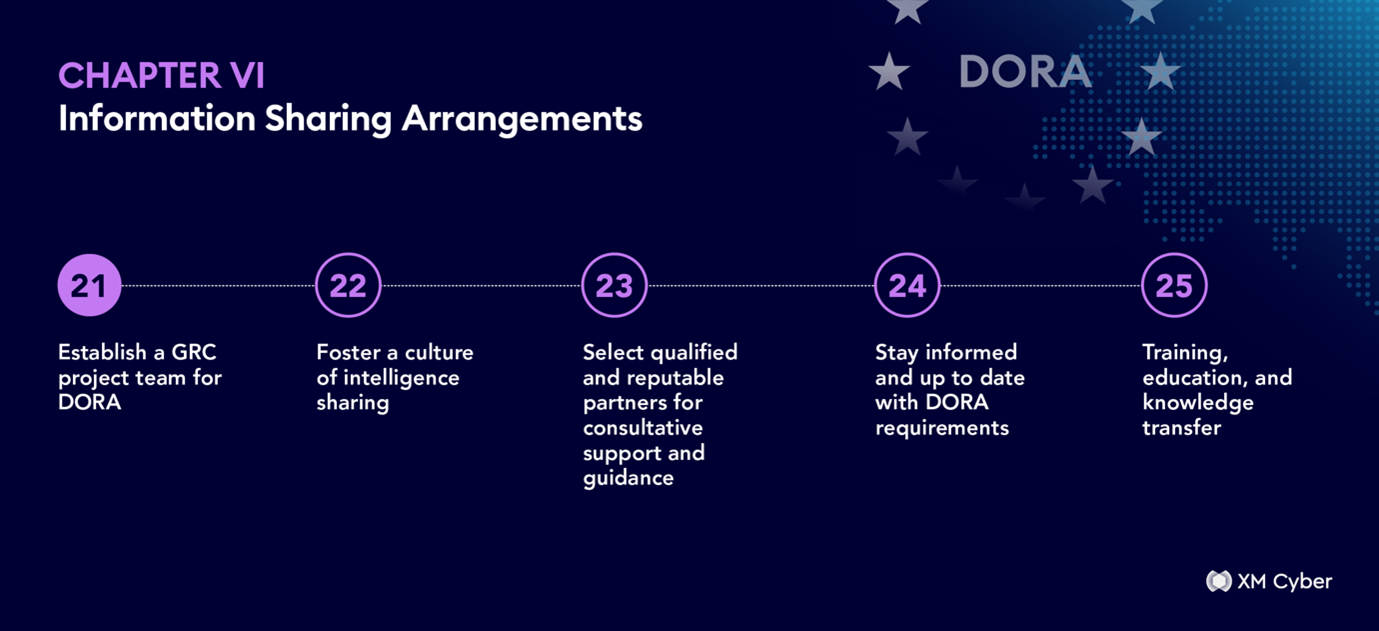

Chapter VI- Information Sharing Arrangements:

☐ Establish a GRC project team for DORA:

Extend your Governance, Risk, and Compliance teams and processes to incorporate and manage the DORA program and framework.

☐ Foster a culture of intelligence sharing:

With industry counterparts, partners, and third-party ICT-related service providers.

☐ Select qualified and reputable partners for consultative support and guidance:

Establish a bi-direction information sharing and communication flow.

☐ Stay informed and up to date with DORA requirements:

Establish a clear line of communication with regulators and authorities

☐ Training, education, and knowledge transfer:

Ensure all team members are suitably educated on all DORA related requirements, processes, and operational resilience measures and their evolution over time.

For more information on the Digital Operational Resilience Act (DORA), please refer to the final text articles which can be found here:

https://www.digital-operational-resilience-act.com/DORA_Articles.html

How XM Cyber Helps Organizations With DORA

Effective exposure management is crucial for financial institutions aiming to align with the Digital Operational Resilience Act. Supporting ICT Risk Management and ICT-related Incident Management with the XM Attack Graph Analysis™ helps you identify, prioritize and validate the exploitability of exposure across the digital attack surface. It ensures security operation teams can focus their remediation efforts and threat investigations on high-impact exposure that present the biggest risk to business-critical assets and ICT systems. It helps optimize digital operational resilience and accelerate the successful adoption of DORA.

Quantification of Risk Using XM Attack Graph Analysis™

The risk intelligence and exposure insights provided through the platform help organizations identify and classify critical ICT assets, and quantify the risk presented by vulnerabilities, misconfiguration, weak security posture, and identity issues across their digital attack surface on a continuous basis, to optimize ICT Risk Management.

Accelerate and Enrich Incident Investigation to Aid Recovery and Prevent Future Breaches

Holistic exposure risk intelligence and attack path insights enrich advanced Threat Hunting and post-incident investigation. It provides rich contextual information reported in threat scenarios to accelerate incident investigation, and enhances the learning and evolution of the ICT-related Incident Management processes.

Simplify Digital Operational Resilience Testing

The platform delivers a comprehensive, continuous, and automated approach to support digital operational resilience testing. The XM Cyber platform delivers end-to-end testing of the external attack surface of financial entities and their third-party ICT service providers, as well and internal digital attack surface testing for vulnerability assessments, security control testing. It provides a continuous approach to Threat-led Penetration Testing, to aid audit readiness, uncover risk, and prevent cyber threats.